borang c due date

Due Date For Submission of Return Form Does Not Carry On Business Carry On Business BE B and P BT M MT TP TJ dan TF 30th April 2022-30th April 2022-30th June 2022 30th June 2022 UPDATED AS AT 08022022. Teruskan membaca di sini untuk pendapatan penggajian yang dikenakan income tax malaysia.

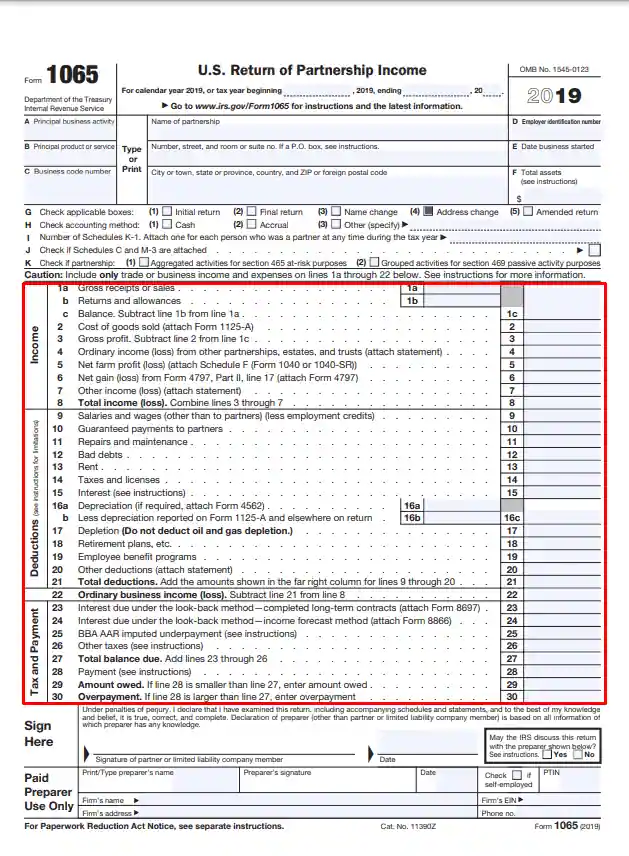

Irs Form 1065 Fill Out Printable Pdf Forms Online

Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021.

. Cara Isi borang nyata cukai pendapatan Bila Tarikh buka Tarikh akhir e filing 2021 yang disediakan untuk efiling 2022 lhdn Lembaga Hasil Dalam Negeri sebelum tutup masa deadline. Although a partnership is not subjected to pay tax it still has to file an annual income tax return. Click on Generate Form E for 2020.

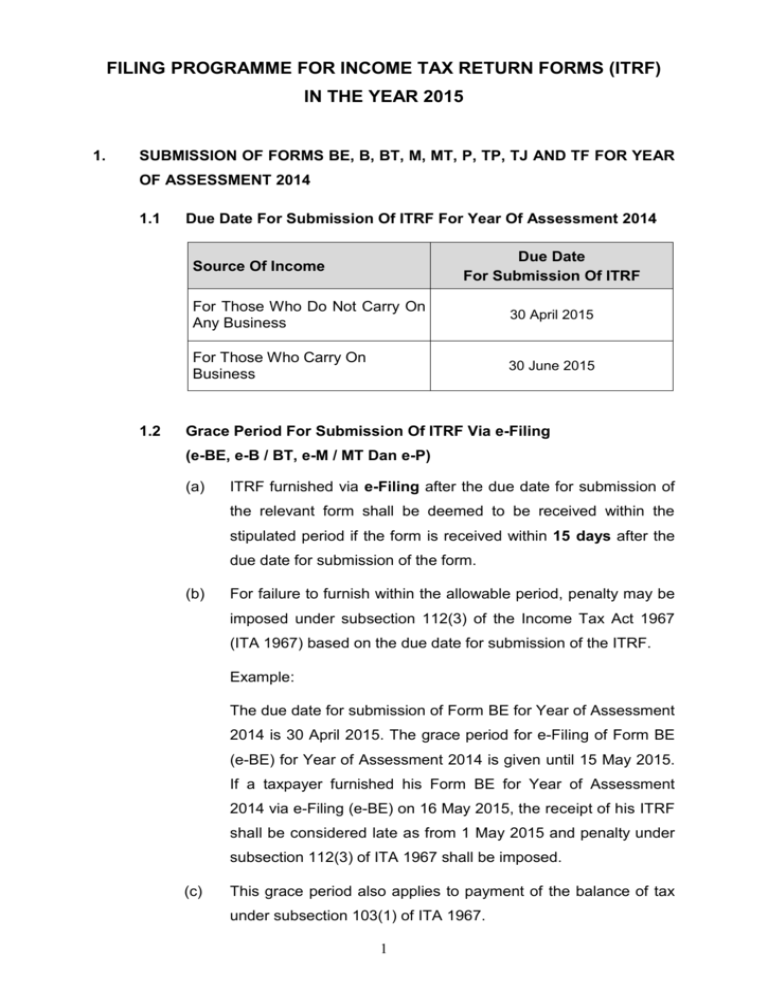

If a taxpayer furnished his Form e-B for Year of Assessment 2021 on 16 July 2022 the receipt of his RF shall be considered late as from 1 July 2022 and. Taxpayers may visit any nearest LHDNM branch for assistance in completing the Income Tax Return Form Or call Hasil Care Line at 03-89111000 Local 603-89111100 Overseas for further explanation. Also the MIRB has closed all its office premises until 14 April 2020.

The Malaysian Inland Revenue Department LHDN officially announced the 2021 income tax filing deadline. Income tax return for individual with business income income other than employment income Deadline. Taxpayers and employers which are companies are compulsorily required to submit Form C and Form E via e-Filing.

Due date to furnish this form a 1967 ITA 1967. Death certificate of the deceased. We hereby attached 2021 LHDN Filing Program for your reference.

7 months from the close of accounting period 2 This sample form is provided for reference and learning purpose. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan. Form B deadline.

The due date for submission of Form B for Year of Assessment 2021 is 30 June 2022. C IMPORTANT REMINDER 1. 31 March 20 2 Form E will only be considered complete if CP8D is submitted on or before 31 March 2022.

The Inland Revenue Board LHDN has reminded taxpayers that they will be able to begin filing their taxes for the year of assessment 2021 YA2021 starting from 1 March 2022. 31 2022 to send. Companies and limited liability partnerships are compulsorily required to submit return form Form C PT via e-Filing.

Cara Isi eFiling LHDN 2022. 3 This sample form CANNOT be used for the purpose of submission to. Death certificate of the deceased.

BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. Double-check each employees Borang E to ensure that everything is in place.

EA Form and CP8D forms are available in both English and Malay versions but the Excel versions are only available in. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. Ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 September 2019 until 31 December 2019 Two 2 months grace period from the due date of submission is allowed for those with accounting period ending 1 January 2020 until 31 March 2020 Form C Companies 31 July 2019 30 Sep 2019.

Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap. Form to be received by IRB within 1 month after the due date. Form P refers to income tax return for partnerships.

30062022 15072022 for e-filing 6. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Cross-check all E forms information to make sure everything is in order and written correctly.

1 Due date to furnish Form e-C and pay the balance of tax payable. CP204 FYE April 2021 CP204A-6 FYE Sep 2020 CP204-9 FYE June 2020 Corporate Tax Estimate Return. Go to Payroll Payroll Settings Form E.

In a statement LHDN explained that the e-Filing. Income tax return for partnerships. Head over to Payroll Payroll Settings Form E.

Malaysia Various Tax Deadlines Extended Due. Borang CP8A CP8C EA EC - to all employees on or before 28 February 2021. No grace period.

Tindakan di bawah subseksyen 120 1 ACP 1967. The submission of their income tax form for forms E BE B M BT MT TF and TP can be made through e-Filing. Once that is done click on Download Form E sign and submit via E-Filing.

Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 1 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mac 2022 dan boleh. B Via postal delivery. Form E Non-company Non-Labuan company employers 31 March 2021.

31 March 2020 submission 15 April 2020 payment. Form Method of Submission Grace Period e-BE m-BE e-B BT e-M MT e-P and e-TP BE B BT M MT. General submission due date.

We have located the specific links to these forms for easy download. Employers who have submitted information via e-Data Praisi need not complete and furnish CP8D. Grace period is given until 15 July 2022 for the e-Filing of Form B Form e-B for Year of Assessment 2021.

Taxpayers may visit any nearest LHDNM branch for assistance in completing the Income Tax Return Form Or call the Hasil Care Line at the hotline 03-89111000 603-89111100 Overseas for further explanation. Employers which are Sole. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021. Many of the Income Tax related forms are quite difficult to find. Income tax return for individual who only received employment income.

Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE tahun taksiran 2021. Tarikh Akhir e Filing 2021. Lhdn b form 2021 due date.

Within 1 month after the due date. 30042022 15052022 for e-filing 5. Within 3 working days after the due date.

Individual BE form without business source - on or before 30 April 2021. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. Income tax return for partnership.

1st quarter of 2021 will be our busy months to process and complete gazette tax filing. To prepare Form E for printing for electronic filing you can refer to the guide below or follow these steps. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022.

THK Management Advisory Sdn Bhd - Latest update on CP 500 - Feb 18 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. Click Create Form E for 2021. With Talenox Payroll you can submit Borang E in just 3 steps.

Within 7 months from the date following the end of the. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis.

Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. Workers or employers can. Once you have done this step click on Download Form E.

Program Memfail Borang Tahun 2009 Dan Isu

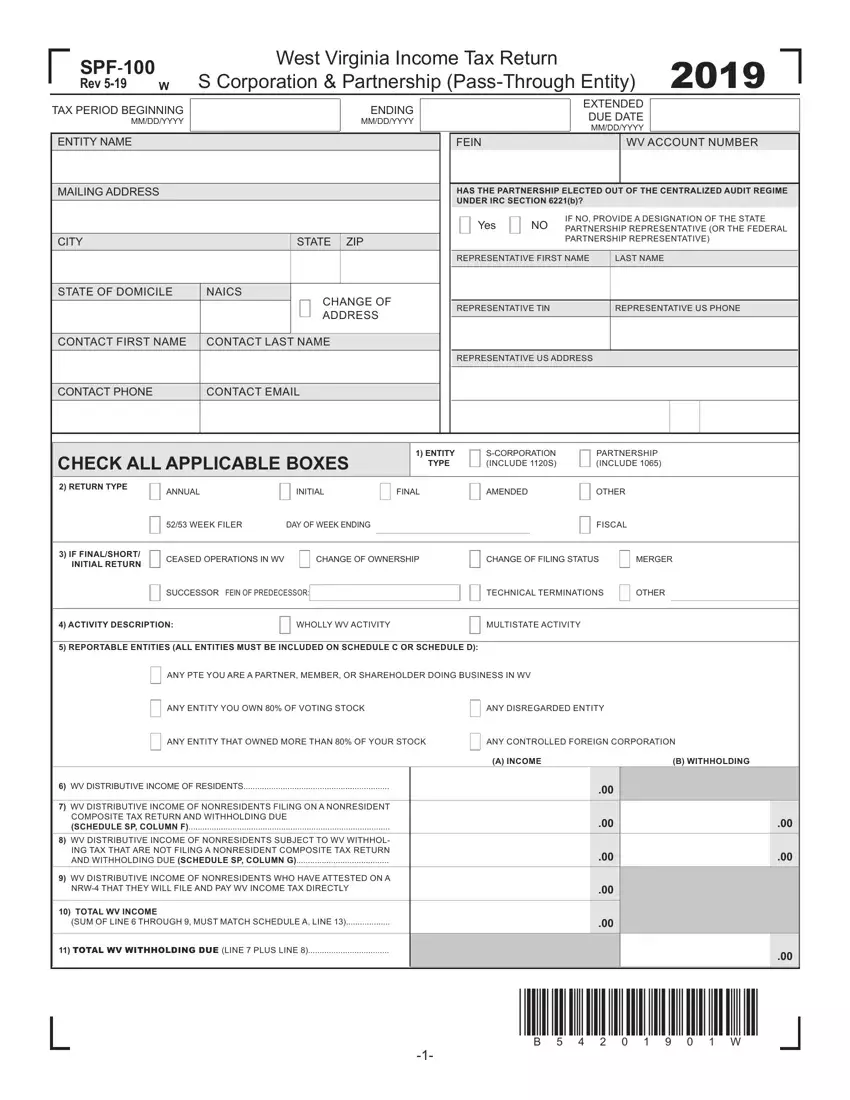

Form Spf 100 Fill Out Printable Pdf Forms Online

A Guide To Corporate Tax Filing In Singapore 2022 Update

Business Income Tax Malaysia Deadlines For 2021

Max Co Chartered Accountants Posts Facebook

2021 Income Tax Return Filing Programme Issued Ey Malaysia

Business Income Tax Malaysia Deadlines For 2021

Max Co Chartered Accountants Posts Facebook

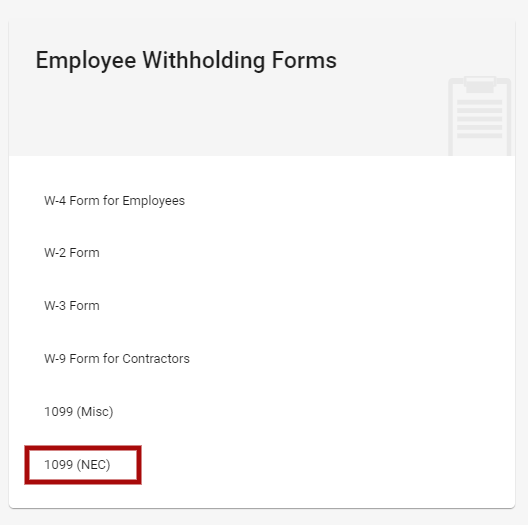

Usa Payroll Compliance What Is Form 1099 Nec And How To Generate A 1099 Nec Form Using Deskera People

Max Co Chartered Accountants Posts Facebook

My Mohr Borang C Fill And Sign Printable Template Online Us Legal Forms

Borang C 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

No Extension For Income Tax Filing The Star

Borang Pengesahan Status Tesis Faculty Of Electrical Engineering

Form Be For Reference Only Pdf Lembaga Hasil Dalam Negeri Malaysia Return Form Of An Individual Resident Who Does Not Carry Business Under Section Course Hero

No comments for "borang c due date"

Post a Comment